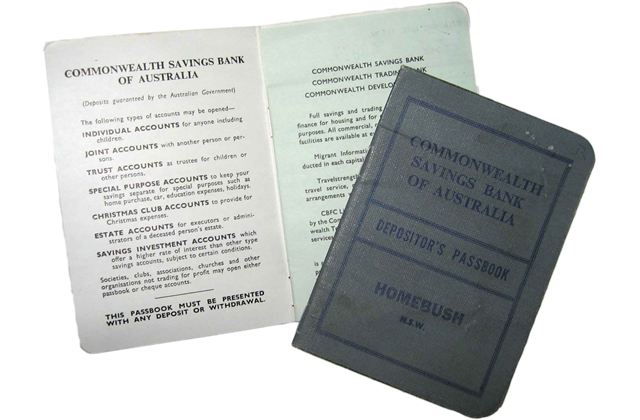

Speaking in Canberra on Tuesday 1 September, Prime Minister Tony Abbott has formally stated that the much talked about plans to impose a tax, or levy, on bank deposits in Australia has been officially dumped. The proposed bank deposit tax in Australia is no more and never made it to fruition. In a media release from the Liberal Party, the following was offered: “Labor’s Bank Deposit Tax would have penalised Australians for being financially responsible. “This Government is in the business of protecting Australians’ savings – not raiding them.” The plan to tax bank depositors’ funds was viewed as critically flawed, and misaligned with incentives for promoting economic and financial stability within the banking system. Although scrapping the proposed bank deposit tax will leave a shortfall of A$1.5 billion in projected budget revenue for the Australian Government, it is also A$1.5 billion less savers will be paying out in tax. ...

Read More »The Economy

Are the New Levels of Australia’s National Terrorism Threat Advisory System Seriously Flawed?

Level of Discussion The Council of Australian Governments (COAG), held its 40th meeting in Sydney, 23 July 2015. Amongst the topics of discussion, was the proposed changes to Australia’s National Terrorism Public Alert System in an effort to ensure that the threat levels “provide more precision, and provide better information to the public on changes to the national terrorism threat level”. Under the existing National Terrorism Public Alert System as used to “communicate an assessed risk of terrorist threat to Australia” there are four alert levels: Low: Terrorist attack is not expected. Medium: Terrorist attack could occur. High: Terrorist attack is likely. Extreme: Terrorist attack is imminent or has occurred. As stated within the levels, the current system is conveying the expectation of a terrorist attack. In addition to being a source of public awareness, the system also aims to guide preparation and planning, inclusive of precaution and vigilance undertaken ...

Read More »The Superannuation System is Not Sexist

As was recently reported on the Australian television channel SBS, on 7 July by The Feed, the superannuation system in Australia is apparently biased against women. Drawing upon the Australian Government Productivity Commission’s research paper for Superannuation Policy for Post-Retirement, the television show states that “there is a massive gap in super funds between men and women”. With the show citing estimates of average retirement payouts from superannuation for men were around $250,000 and for women around $150,000. Whilst The Feed tends to be a rather irreverent look at news and currents events – and is best treated and viewed as such – the suggestion that the difference in superannuation retirement payouts between males and females is because super is a “dude’s system” is utterly false. Even acknowledging and allowing for the tongue-in-cheek nature of The Feed, this line of specious reasoning that somehow the superannuation system unfairly favours males ...

Read More »Decadent Claims: Why Same-Sex Marriage Should Not be Decided by Politicians

Question: How does Barnaby Joyce think Asia will see Australia if same-sex marriage is legalised? Answer: As “decadent”. It may have been difficult to believe that Agriculture Minister Barnaby Joyce could’ve topped his earlier comments about Johnny Depp’s dogs being “stateless” but clearly there’s a new contender. Joyce is arguably taking his cues on this matter from his fellow cabinet minister, Senator Eric Abetz whose views have included that same-sex marriage may lead to polyamory; and then there were earlier comments from Senator Cory Bernardi that same-sex marriage could lead to an acceptance of bestiality. In reference to Asian countries, Barnaby Joyce said the following regarding same-sex marriage: “When we go there, there are judgements, whether you like it or not that are made about us. “They see us as decadent.” When asked if Australia embracing gay marriage would be seen as decadent in Asia, Mr Joyce said: “I think ...

Read More »Popless Bubble Wrap: Packages Compactness, Economises on Excitement

Bubble Wrap without its pop may be a bit like soda pop without the fizz, sure it’s more compact, but where’s the fun? Bubble wrap and that oh-so-satisfying popping of its bubbles may be set to become a thing of the past. Keep calm. Deep breaths. Inhale, and, exhale. Inhale, and, exhale. Bubble wrap as known in its traditional form with the individually sealed blisters or bubbles of air was invented in 1957, and since 1960 and has been sold under the name of Bubble Wrap by the company Sealed Air. Although not the only company to sell bubble wrap, and variants do exist, Sealed Air is changing things up with its new protective packaging and wrapping solution. The name of the new product, rather uninspiringly, is iBubble Wrap. (Surely by now the bubble in iNames would’ve burst, but predicting that may have to wait for the benefit of hindsight.) ...

Read More »Tamponomics and Taxing Tampons with GST

Tamponomics, one has to marvel at the ability of the word “economics” to absorb whatever is thrown at the dismal science. This time around, it’s the debate about whether GST should apply to tampons in Australia. So much so, that it has caused a minor rift between Treasurer Joe Hockey and Prime Minister Tony Abbott. Only in the land down under. At present in Australia, a 10 percent Goods and Services Tax (GST) is applied to the cost of tampons. This has been the case since the tax was first introduced. The debate that the GST should not apply to tampons is not new either. It has been there from the beginning as well. In Australia, tampons are treated as a “luxury” item making them subject to the GST, unlike certain “essential” items which are not. The current revamping of the debate occurred in a major way on Tuesday 26 ...

Read More »Uber to Charge GST in Australia

As of 1 August 2015, Uber drivers in Australia will need to be registered for, and start charging GST. The 10 percent Goods and Services Tax (GST) will apply for people paying for a ride using the ride-sharing service Uber. This is consistent with the Australian Government’s move to begin charging the GST on digital products (including those purchased internationally, even if costing under A$1,000). In many regards, this has the acknowledgement that the digital economy, alternatively referred to as the sharing economy, is here to stay. Despite concerns related to Uber, predominantly by those in the taxi industry, this move suggests legitimising the business of Uber from a governmental perspective. Naturally there’s money involved. With Uber drivers to start charging GST, this brings them in line with taxi drivers charging GST. Beyond paying tax in the obvious method via the GST, it also closes the various loopholes which had ...

Read More »Australia to Charge GST on Digital Products

Australia is now to implement its 10 percent GST on digital downloads for items purchased by Australians from international sellers. Dubbed the “Netflix Tax” it will apply to digital goods sold by those such as Amazon, Google, and Netflix. The now inclusive 10 percent Goods and Services Tax (GST) will be charged on all digital products and services bought online, including books, games, movies, and music. Treasurer Joe Hockey has stated that the current GST exemption for online purchases of items under A$1,000 will continue to apply for physical goods. (Note that the A$1,000 amount includes the full cost, including shipping to bring it to Australia.) In some ways, adding the GST to digital goods Australians purchase will bring things in line with the business and tax practices already faced by Australian businesses and those doing business in Australia. Which could be regarded as a levelling of the playing field. For example, ...

Read More »McDonald’s Reboots Hamburglar Mascot to Purloin the Sirloin and Save Company

McDonald’s the once mighty, how it has fallen. For a long time McDonald’s was iconic, and while it still enjoys brand recognition, with the Golden Arches becoming more recognised than the cross of Christianity, its relevance is again being questioned. With this, so too are revenue and profits falling. Whereas profits vary from quarter to quarter, within a business, especially a giant corporation such as McDonald’s, revenue tends to be more stable. However, revenue itself fell near 7 percent to US$6.57 billion in the December 2014 quarter. Granted it is still profitable, but consider that’s a difference of near US$415 million less revenue for the quarter. It faced a challenging 2014, including food safety scandals and supplier issues in Asia, closures of restaurants in Russia and Ukraine, and declining sales in its US heartland attributed largely to increased competition. When it comes to the McDonald’s of today, people are increasingly ...

Read More »Monetary Policy and Interest Rates: Proportions or Basis Points?

Monetary policy as it currently stands, is more mess and mysticism than most would like to believe. Yet it is also this belief, the elusive notion of confidence through words aimed at shaping expectations, that give it much of its power. Phrases such as “jawboning” and “paring” and “animal spirits” have all become part of the modern-day central banker toolkit. Along with the other main lever of monetary policy, the ability to raise or lower interest rates at the short end of the yield curve. Beyond the phraseology, the longer end of the yield curve has seen elements of intervention with quantitative easing and bond buying programs. However, the short end, with the official cash rate (with a name that varies between countries) remains the primary element of conventional monetary policy. Macroeconomics recognises that monetary to policy is a blunt instrument. It’s often likened more to being a cudgel than ...

Read More » uthinki Considered Opinion?

uthinki Considered Opinion?